Real estate can be one of the most stable and lucrative investment types available to those looking to expand their portfolios. This is especially true in markets like the Philippines where long-term economic expansion has proven valuable to homeowners of all backgrounds. Now, … [Read more...]

Five Effective Tips for Buying Villa in Dubai

It is crucial to understand the market before you purchase from it. That is because an understanding of the market can help in multifaceted ways; for example: It helps you negotiate better and know the minimum or maximum benchmark for products or properties as the case may … [Read more...]

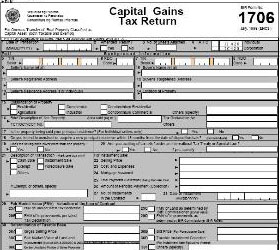

How to Compute Capital Gains Tax on Sale of Real Property

How to Compute Capital Gains Tax on Sale of Real Property in the Philippines? When a person sells real property, classified as “capital asset”, he may be liable for taxes, which include local property taxes, documentary stamp tax and capital gains tax. Capital Gains Tax, as it … [Read more...]

How to Compute Documentary Stamp Tax (DST) on Transfer of Real Property

How to compute Documentary Stamp Tax (DST) on transfer of real property in the Philippines? When we sell or buy real property, we execute a contract or deed of absolute sale, where the selling price, parties, details of property and other stipulations are stated. The deed of sale … [Read more...]