What’s the difference between a Sales Invoice and an Official Receipt? To address this question, the following are some of the differences of sales invoices and official receipts: Sales Invoice Official Receipt 1. A sales invoice is a … [Read more...]

Examples of Adjusting Journal Entries in Accounting

In our previous post titled how to make adjusting journal entries (AJE), we have discussed the common types of adjusting entries, namely, accrued revenues, accrued expenses, unearned revenues, prepaid expenses, depreciation (estimation), change in accounting estimate, and prior … [Read more...]

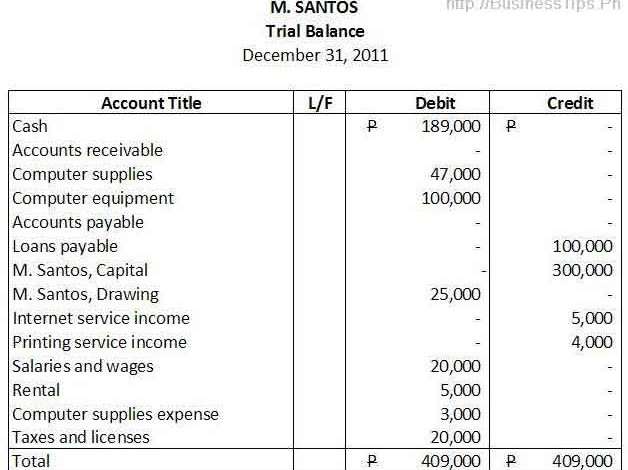

How to Prepare a Trial Balance

A trial balance is an internal accounting statement prepared to check the accuracy of the company’s accounting records. As the “trial” on its name suggests, it is made to check if there are errors committed during the accounting process, which involves journalizing and posting … [Read more...]

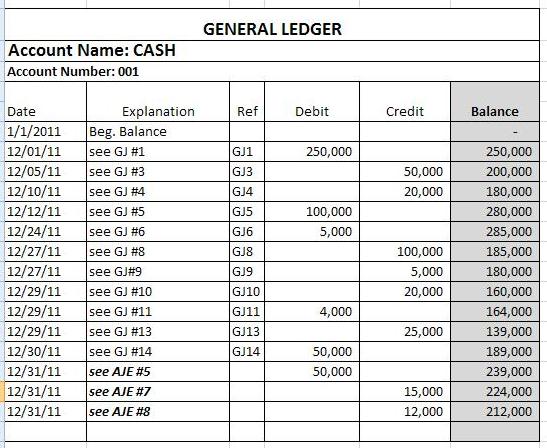

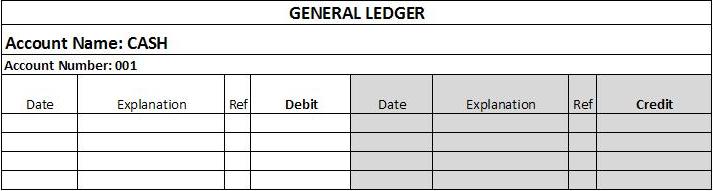

How to Post Journal Entries to the General Ledger

After journalizing your business transactions, that is, recording them in the general or special journals, the next step is to post those journal entries in the general ledger accounts. To learn about recording transactions in the general journal, please read our previous article … [Read more...]

How to Make Accounting Journal Entries

After identifying and measuring your business transactions, you will now move to the recording process of accounting. The first phase of recording is making the journal entries (journalizing) that should be recorded in the general journal or special journals, such as sales … [Read more...]