The Philippines’ Social Security System (SSS) is a government-run program that provides social insurance for workers belonging to the private sector. Additionally, SSS also caters to professionals and other members of the informal sectors. By the virtue of the country’s Republic … [Read more...]

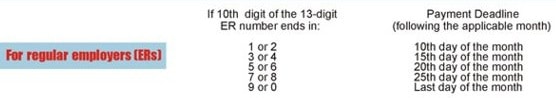

SSS Contribution Table and Deadline of Payments

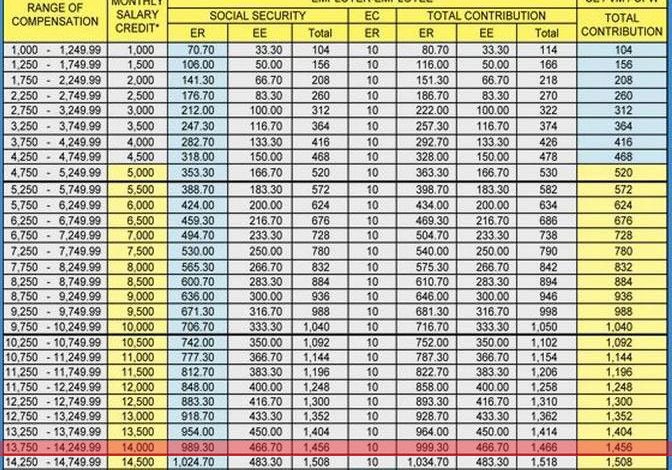

The Social Security System (SSS) contribution table is the schedule of the members’ monthly salary bracket and their corresponding employers’ share on contributions and total monthly contributions to be remitted with the SSS for employees, self-employed (SE) members, voluntary … [Read more...]

How to Register Your Business with the SSS

The Philippine government is bound to protect the welfare of employees and workers in the country. That is why through labor and social security laws, it mandates and obliges businesses and employers to ensure that their hired employees or laborers are covered by viable … [Read more...]

How to Compute SSS Contributions in the Philippines

How to compute SSS contribution in the Philippines? Employers must know how much employer’s contribution (ER) they must pay to the Philippine Social Security System (SSS) for their employers. If you’re an employee, you might also ask how much employee’s contribution (EE) is … [Read more...]