As we know it, employers are basically required to deduct and withhold tax from the compensation or salary they pay to their employees. When computing for the withholding tax on compensation income, the following methods are prescribed by the BIR Revenue Regulations No. … [Read more...]

What are the Income Tax Rates in the Philippines for Individuals?

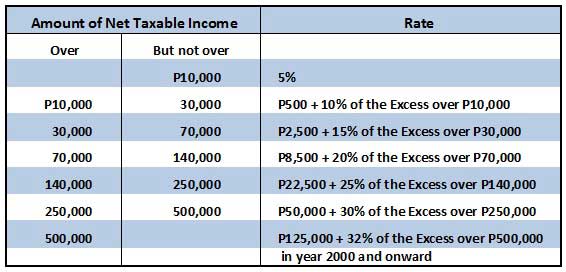

What are the income tax rates in the Philippines for individuals? Individual taxpayers, as opposed to corporations and partnerships, include employees and self-employed persons engaged in business or practice of profession. The Philippines usually uses graduated income tax rates … [Read more...]