There is only one week left until April 15 is here – the deadline for annual income tax filing. If you are already done filing your income tax return with the BIR, then congratulations for making it earlier than the due date. For others who have not yet filed their income tax … [Read more...]

Top Taxpayers in the Philippines

Taxes are the lifeblood of our country. Without tax collections, our nation won’t be able to construct bridges, streets, schools, hospitals, and other infrastructures for the public consumption. Without taxes, our government agencies and offices won’t run to serve the citizens. … [Read more...]

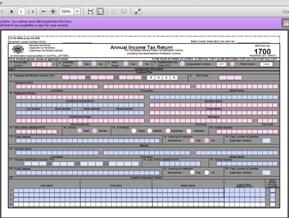

BIR Interactive Forms for Income Tax Filing Now Available

On November 2011, the Bureau of Internal Revenue (BIR) has issued Revenue Regulation No. 19-2011, requiring taxpayers to use the revised forms for filing their income tax returns. The new forms, which include BIR Form 1700 (Annual Income Tax Return for Individuals Earning Purely … [Read more...]

How to Replace Lost or Damaged BIR TIN Card

How to replace lost or damaged BIR TIN (Taxpayer Identification Number) card? If you have already registered a TIN before, but have lost your TIN card, or if your card has been damaged, here are the steps you can do to replace your TIN card and have a new one. 1. Know the BIR … [Read more...]

How to Make Your Small Business Legal

You started it as a hobby, and then you’ve decided to start a small business out of it. It can be online, such as website development, search engine optimization, graphic designing or selling stuff on the Internet. It might also be something you’ve started at home without the … [Read more...]

New and Revised Income Tax Return BIR Forms

Taxpayers who are required to file their income tax returns under the Tax code, and those who are not required but opt to do so, will be filing with the new income tax returns issued by the BIR. This is for their annual income tax covering and starting calendar year 2011, which … [Read more...]

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- …

- 7

- Next Page »