Tax affects everyone’s life, not only for business owners and employees, but also for anyone who is under the government. Income earned, whether from business profit or from employment compensation, is generally taxed. The commodities and services everyone consumes may also be … [Read more...]

Tax Tips for Income Tax Filing and Preparation in 2012

In a few months from now, we will be filing our annual income tax return for the calendar year 2011. In the Philippines, income tax returns for the taxable calendar year are to be filed on or before the 15th of April. Since April 15, 2012 will fall on Sunday, we can assume that … [Read more...]

Business in the Philippines

I am encouraging Filipinos to do business in the Philippines. Let us start entrepreneurship and start our own business. It is risky, but our country needs business heroes and leaders. The problem of unemployment in our nation is already apparent and even the employed ones are not … [Read more...]

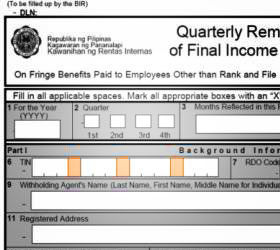

How to Compute Fringe Benefit Tax (FBT) in the Philippines

Employees are considered by many as the best assets in business organizations. They are the labor force that contributes to the productivity, as well as profitability and stability of any enterprise. Thus, making employees and workers motivated and happy is a necessity for every … [Read more...]

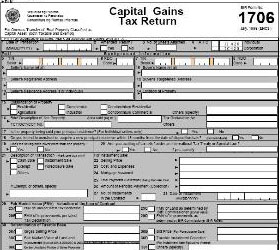

How to Compute Capital Gains Tax on Sale of Real Property

How to Compute Capital Gains Tax on Sale of Real Property in the Philippines? When a person sells real property, classified as “capital asset”, he may be liable for taxes, which include local property taxes, documentary stamp tax and capital gains tax. Capital Gains Tax, as it … [Read more...]

How to Compute Documentary Stamp Tax (DST) on Transfer of Real Property

How to compute Documentary Stamp Tax (DST) on transfer of real property in the Philippines? When we sell or buy real property, we execute a contract or deed of absolute sale, where the selling price, parties, details of property and other stipulations are stated. The deed of sale … [Read more...]