What is a sin tax? Sin tax, as it name suggests, is a tax levied on products or activities, which are considered sinful or harmful and considered as objects of social disapproval, such as liquor, tobacco and gambling. Sin tax or sometimes called sumptuary tax or sumptuary law is … [Read more...]

How to get a TIN ID from the BIR Philippines

How to get a TIN (Taxpayer Identification Number) ID from the BIR in the Philippines? Before you can file your taxes with the government through the Bureau of Internal Revenue, you need to supply your BIR form with a TIN. Likewise, before your employer (if you’re a local … [Read more...]

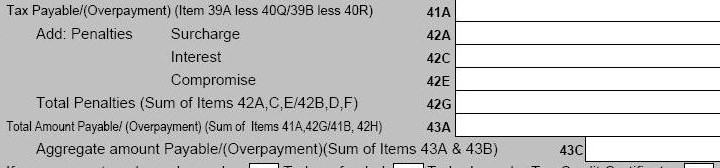

Penalties for Late Filing of Tax Returns

How to compute the penalties for late filing of income tax return in Philippines? Maybe you’re one of those taxpayers who are searching the Internet right now for any clue and answer to that question. The deadline for filing and payment of the annual income tax is April 15. But … [Read more...]

Deductible Expenses (Allowable Deductions) in the Philippines

April 15 is fast approaching, and if you have taxable income, you need to file and pay your income tax before that due date. In computing your income tax, you need to determine your deductible costs and expenses to arrive at your net taxable income. In doing the computation, we … [Read more...]

BIR Tax Filing and Payment Deadlines (Income Taxes)

People need money to finance their cost of living (i.e., food, clothing, medicine, education, leisure, et cetera). Thus, they strive and work hard to earn such money to cover those expenses. However, in almost every country, especially the Philippines, tax is inherent. Income tax … [Read more...]

20 Tips to Avoid BIR Tax Penalties

Taxes are burden imposed to persons and entities who earn income, engage in business, transfer personal or real properties, and other taxpayers who are required to pay taxes by the National Internal Revenue Code (NIRC) and other applicable laws. If a tax means cash outlay, … [Read more...]

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- 7

- Next Page »