Unlike large companies and corporations, small companies and micro businesses may not afford to establish a tax and accounting department or hire accounting firms to do the tedious tasks of taxation, accounting and bookkeeping for their business. That is why they sometimes have … [Read more...]

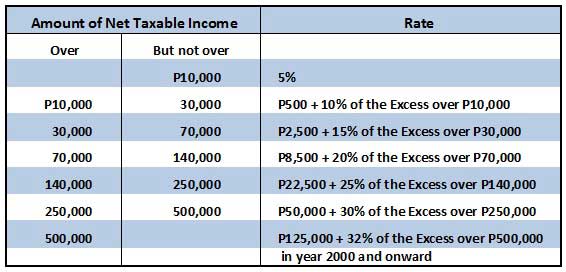

What are the Income Tax Rates in the Philippines for Individuals?

What are the income tax rates in the Philippines for individuals? Individual taxpayers, as opposed to corporations and partnerships, include employees and self-employed persons engaged in business or practice of profession. The Philippines usually uses graduated income tax rates … [Read more...]

BIR Annual Registration Fee Deadline

When is the deadline for paying our BIR annual registration fee? The BIR annual registration fee, using BIR Form 0605 (Payment Form) should be filed and paid upon registration of your new business and on or before January 31 of every year for renewals. In other words, the BIR … [Read more...]

6 Factors to Consider when Investing in the Philippines

For foreign investment in the Philippines to be formally established, it is required to register a legal business entity. The choice of a better structure would contribute to a smooth flow of its intended operations, and a bad choice would lead to so much waste. More importantly, … [Read more...]

Tax Tips for Income Tax Filing and Preparation in 2012

In a few months from now, we will be filing our annual income tax return for the calendar year 2011. In the Philippines, income tax returns for the taxable calendar year are to be filed on or before the 15th of April. Since April 15, 2012 will fall on Sunday, we can assume that … [Read more...]

Business Guide in the Philippines

This post lists and summarizes all of our published tips, stories and articles for your business guide in the Philippines. It also includes outside links which we consider very helpful in achieving your short-term and long-term business objectives. We understand that success is … [Read more...]