In order to encourage taxpayers in the Philippines to file and pay their taxes on or before the due date, the BIR and DOF impose penalties for late filing of any tax declarations. Basically, the tax penalty here is composed of interest (20% per annum), surcharge (outright 25% if … [Read more...]

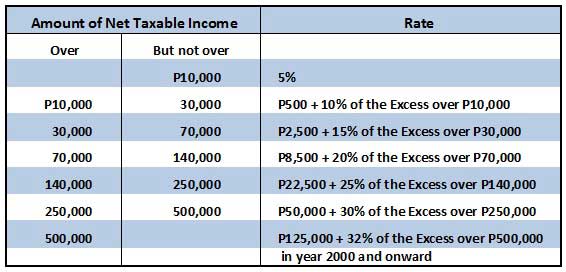

What are the Income Tax Rates in the Philippines for Individuals?

What are the income tax rates in the Philippines for individuals? Individual taxpayers, as opposed to corporations and partnerships, include employees and self-employed persons engaged in business or practice of profession. The Philippines usually uses graduated income tax rates … [Read more...]

How to Get TIN (Taxpayer Identification Number) for Unemployed Individuals

A TIN (Taxpayer Identification Number) is usually given to new taxpayers, such as individual taxpayers (i.e., single proprietors, professionals, employees, and mixed income earners) and juridical taxpayers (e.g., partnerships and corporations). If you fall under those categories, … [Read more...]

10 Mistakes to Avoid When Filing Income Tax Return

There is only one week left until April 15 is here – the deadline for annual income tax filing. If you are already done filing your income tax return with the BIR, then congratulations for making it earlier than the due date. For others who have not yet filed their income tax … [Read more...]

Top Taxpayers in the Philippines

Taxes are the lifeblood of our country. Without tax collections, our nation won’t be able to construct bridges, streets, schools, hospitals, and other infrastructures for the public consumption. Without taxes, our government agencies and offices won’t run to serve the citizens. … [Read more...]

What are Deductions and Exemptions to Income Tax (Philippines)

What are the deductions and exemptions you can claim against your taxable income in computing income tax and preparing your annual tax return? The computation for income tax expense and payable for individuals and corporations (including taxable partnerships) differs. Individual … [Read more...]