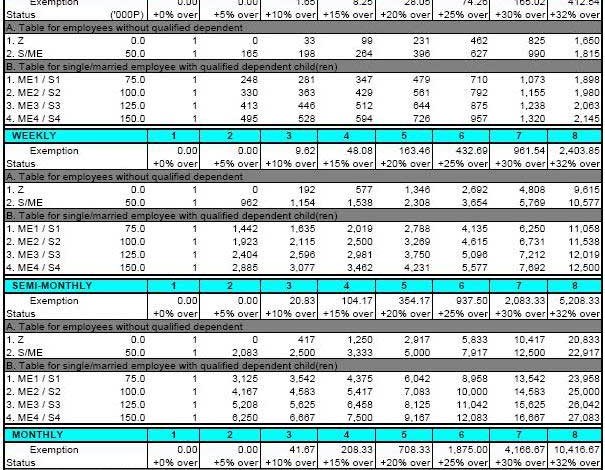

As we know it, employers are basically required to deduct and withhold tax from the compensation or salary they pay to their employees. When computing for the withholding tax on compensation income, the following methods are prescribed by the BIR Revenue Regulations No. … [Read more...]

How to Claim Employees’ Income Tax Refund in the Philippines

How can employees claim their income tax refund? If you are an employee, you may notice that your employer is deducting and withholding a tax amount on your compensation income on a monthly basis. Your employer is just actually complying with the Bureau of Internal Revenue (BIR). … [Read more...]

How to Compute Fringe Benefit Tax (FBT) in the Philippines

Employees are considered by many as the best assets in business organizations. They are the labor force that contributes to the productivity, as well as profitability and stability of any enterprise. Thus, making employees and workers motivated and happy is a necessity for every … [Read more...]

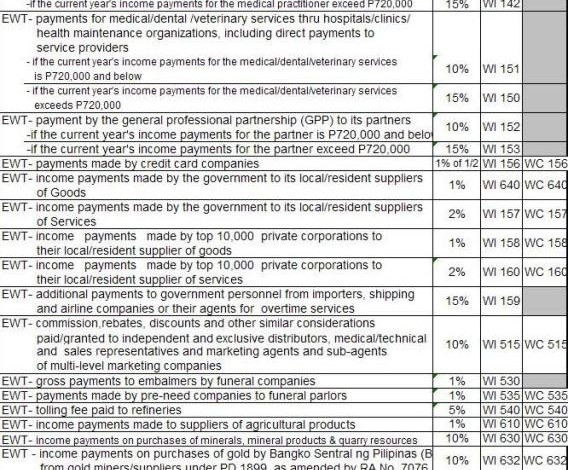

How to Compute Expanded Withholding Tax in the Philippines

How to compute expanded withholding tax in the Philippines? How to file BIR Form 1601-E or the Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) return? This is the follow up post on our previous published article titled “Expanded Withholding Tax in the … [Read more...]

Expanded Withholding Tax in the Philippines

Expanded withholding tax on certain income payments and withholding tax on compensation are two of the common withholding taxes you should withheld and remit to the government, when applicable. In turn, the payees of these income payments can claim those taxes withheld as … [Read more...]

How to Compute Withholding Tax on Compensation (BIR Philippines)

How to compute withholding tax on compensation and wages in the Philippines? If you have seen a Monthly Remittance Return of Income Taxes Withheld on Compensation or BIR Form No. 1601-C, you will only see totals of compensation and tax withheld on compensation of the taxpayer’s … [Read more...]