Early this year, the Philippines government has enacted the Tax Reform for Acceleration and Inclusion (TRAIN) law – a reform initiative that is said to be instrumental to the poverty-reduction and economic development goals of the country. This newly-implemented law has a far and wide-reaching impact to several industries, including the real estate market in the Philippines.

Since the implementation of Train law, the tax schedule for real estate property has changed in many ways. For instance, the rate of the estate tax – a tax imposed on the property of lawful heirs and beneficiaries inherited from a decedent – is now at a flat rate of 6% on the amount in excess of P5 million from the previous 5% to 32% rate.

On the other hand, the Train law has also increased the selling price of brand new properties priced above P1.5 million (for vacant lots) and P2.5 million (for house and lots/condos) as they are now subjected to VAT. This is compared to the previous – and higher – threshold of P1,919,200.00 for vacant lots and P3,199,200 for house and lots.

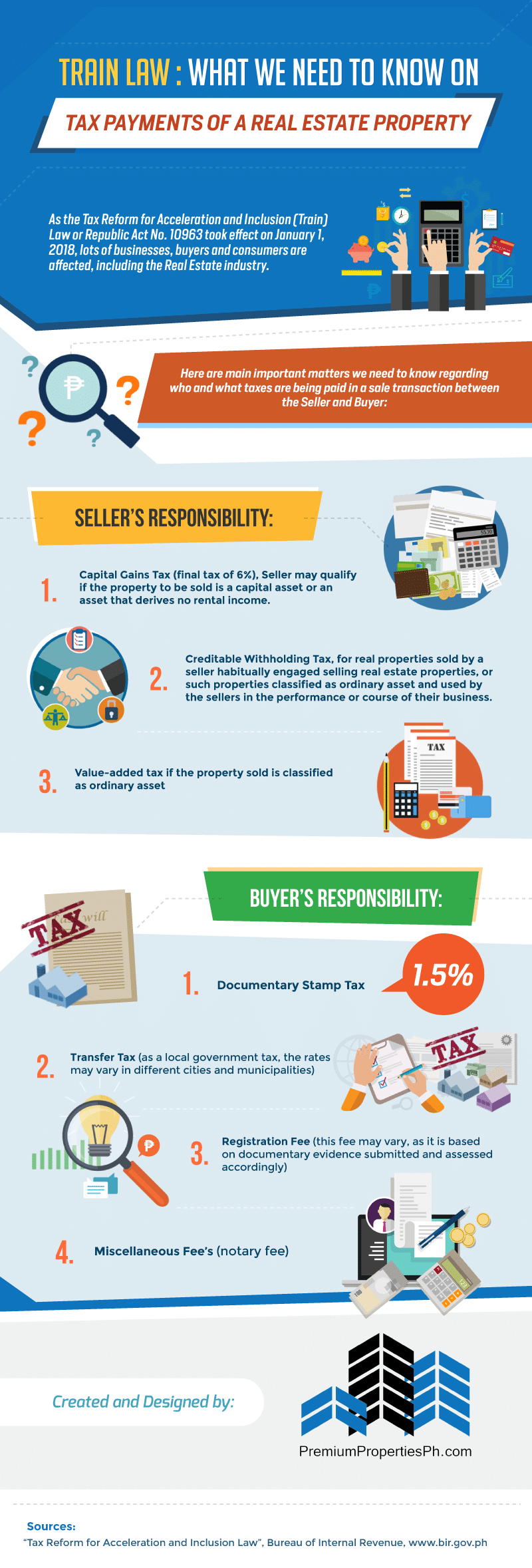

To learn more about the Train Law and how it changed the tax payment in real estate properties in the Philippines, check out this infographic from Premium Properties Ph.

BusinessTips.ph is an online Business Ezine that provides free and useful articles, guide, news, tips, stories and inspirations on business, finance, entrepreneurship, management and leadership, online and offline marketing, law and taxation, and personal and professional development to Filipinos and all the business owners, entrepreneurs, managers, marketers, leaders, teachers and business students around the world.

Leave a Reply