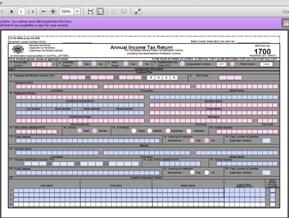

On November 2011, the Bureau of Internal Revenue (BIR) has issued Revenue Regulation No. 19-2011, requiring taxpayers to use the revised forms for filing their income tax returns. The new forms, which include BIR Form 1700 (Annual Income Tax Return for Individuals Earning Purely Compensation Income), BIR Form 1701 (Annual Income Tax Return for Self-Employed Individuals, Estates and Trusts), and BIR Form 1702 (Annual Income Tax Return for Corporation, Partnership and Other Non-Individual Taxpayer), are required correspondingly for individual and non individual taxpayers to use for their annual income tax filing covering and starting calendar year 2011, which is due on or before April 15, 2012. The revised forms include additional fields that are not included in the old forms. That is why taxpayers find them more complicated to fill up than the previous forms. But here comes the good news… the BIR has already made available the “interactive forms” on their website.

On November 2011, the Bureau of Internal Revenue (BIR) has issued Revenue Regulation No. 19-2011, requiring taxpayers to use the revised forms for filing their income tax returns. The new forms, which include BIR Form 1700 (Annual Income Tax Return for Individuals Earning Purely Compensation Income), BIR Form 1701 (Annual Income Tax Return for Self-Employed Individuals, Estates and Trusts), and BIR Form 1702 (Annual Income Tax Return for Corporation, Partnership and Other Non-Individual Taxpayer), are required correspondingly for individual and non individual taxpayers to use for their annual income tax filing covering and starting calendar year 2011, which is due on or before April 15, 2012. The revised forms include additional fields that are not included in the old forms. That is why taxpayers find them more complicated to fill up than the previous forms. But here comes the good news… the BIR has already made available the “interactive forms” on their website.

An interactive form is a document with blank spaces that allows the user to insert data, edit, save and print. The BIR has made available for download interactive format of the November 2011 versions of BIR forms 1700, 1701, and 1702.

You may download the interactive forms in the BIR website forms section. There, you will find a zipped file that contains the Interactive PDF file and an MSWord file for BIR’s guidelines on using the form. In the BIR guidelines, you can read important information, such as the features of the interactive forms, computer system requirements, how to fill up the form, how to print the form, how to file the form, and frequently asked questions.

The interactive forms can be viewed, edited and printed using Acrobat Reader and PDF-Xchange Viewer. However, only the PDF-Xchange Viewer will give you the ability to save the file. Acrobat Reader will only allow you to view, edit and print the interactive form, but it will not allow you to save the file. A link to the website where you can download PDF-Xchange Viewer for free is provided in the BIR’s guideline file included in the zipped file you will download together with the interactive form.

These interactive forms are convenient to use since they can be edited and automatic computations are done even if you don’t have an Internet connection and the form is offline. These automatic computations also avoid errors usually committed in manual computation.

To fill up the form, you just need to place the cursor of the mouse within the boxes and click to start entering data. You can also use the form even without a mouse by using the tab key to move around the form. The form can be saved and the taxpayer can easily edit the form, and re-use it in the future. Another feature of the interactive form is that the items can be validated. For example, fields that require alphabetical characters will not allow a taxpayer to enter numbers and vice versa.

Mandatory items are also outlined in red. Once the taxpayer saves the form without filling up mandatory items, a message will appear stating: “Reminder: You have not yet filled out all the red boxes. If these boxes are not all filled out and this form is submitted, it will be considered incomplete and/or you may be subject to audit.”

In order to use the Interactive Forms, your computer should support Windows 2000/XP/Vista/7 Operating Systems.

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

Hello, I am a freelance programmer and I filed ITR last yr in Manila w/ RDO code 040. I am in Davao now, can I just fill up the BIR form and pay it in the bank here in davao? Thanks.

Hi. You should file in the RDO where you are registered.

thanks sir vic for the response. do i have other options like, can i send my forms to someone in manila and let them file for my ITR? How about if i enrol in their efps? does efps have any disadvantage? thanks in advance.

Yes, you can have a representative manually file your ITR with your signature. As a registered freelance, yes, EFPS is a good option so paying taxes at your own pace and convenience is at its most. Visit your RDO of registration for the requirements, and coordinate with your online banker for the payment arrangements.

Thanks Belle.

thanks sir for the response =)

I suggest you retain a bookkeeper for the purpose. We can help you find one if you would prefer to.

My husband was hired by an agency as a consultant for one company. This agency provides him his 2307. Previously we file his ITR at RDO Makati where he was registered. But his contract with this agency terminated last Jan 31, 2012. And last March 2012 he was hired by another company as their consultant. And this company requested him to register as VAT taxpayer and transfer his RDO from Makati to Bacoor (because we live in Bacoor). And before end of March 2012 he transferred to RDO Bacoor. Consequently in RDO Bacoor he registered as VAT taxpayer.

Is it correct that we only file ITR? And where will we file his ITR for 2011? Is it in RDO Makati or Bacoor? How will we treat his consultancy fee in January and March 2012? What are the consequences now that he is a VAT taxpayer? Thank you in advance.

To Ms. Belle:

I am an undergraduate Accountancy student.I would like to know what are the possible problems encountered by single proprietor taxpayers in filing their Income tax return.Your response would be of great help. Thank You very much Ma’am!

Good evening po I have a little problem with my salary tax deduction. Kasi po sa payroll deduction is php 2554 while sa BIR computation is only php 2055.31. My basic salary is 18549 per month. Can you teach me or give me a formula on how to compute my salary tax? Our bookkeeper told me that from the basic salary kukunin ang tax but the BIR told me that i have to less first the non taxable before i get the taxable income.