In our previous post titled how to make adjusting journal entries (AJE), we have discussed the common types of adjusting entries, namely, accrued revenues, accrued expenses, unearned revenues, prepaid expenses, depreciation (estimation), change in accounting estimate, and prior period errors. We also enumerated some examples of economic events that need to be adjusted to update and correct our records in the journal, ledger, trial balance, and financial statements. Since our post about recording journal entries, we have already presented examples of business transactions to facilitate our discussion. We have continued using those examples in our topics about posting entries in the general ledger and preparing a trial balance. As promised, we will continue those samples here. And to illustrate how to make adjusting entries, let us assume the following examples of accounting events and their corresponding adjusting journal entries in the books of Mr. Santos – the same illustration we have discussed in our article on how to make entries in the general journal.

Examples of Events that need Adjusting Entries

1. The computer equipment of P100,000 is estimated to have a useful life of 5 years. It was decided that a one-month depreciation for December should be provided.

2. As of December 31, the Internet and communication incurred but not yet paid amounted to P4,000.

3. Water and power amounted to P5,000 was incurred during December but still unpaid as of December 31.

4. It was determined that the actual cost of unused computer supplies at the end of year is amounted to P45,000.

5. It was discovered that Internet services worth P66,000 provided to customers on account were erroneously recorded as P6,000. Furthermore, printing services worth P50,000 earned and received on cash were also erroneously omitted in the journal and ledger.

6. An interest of 16% per annum on P100,000 loan from the bank granted on December 12, has accrued.

7. During December, Mr. Santos actually paid P20,000 for the four months of rental fees covering December to March. Only the P5,000 rent payment for December was recorded.

8. Mr. Santos did not record the one-year insurance he paid in cash on December 1 worth P12,000 covering 12 month period from December 1, 2011 to November 30, 2012.

9. Mr. Santos has determined that he has an additional taxes and licenses payable as of December 31 amounted to P5,000, which is due on or before January 20 of the next year.

10. The 2011 income tax due and payable after personal deduction amounted to P75 (only estimated for the purpose of this example).

Adjusting Journal Entries

The following are the adjusting entries based on the above examples. Amounts in the left side represent debit entries, while amounts in the right side represent credit entries.

AJE #1

Depreciation expense P 1,667

Accumulated depreciation P 1,667

To record depreciation expense for the month of December (P100,000/5years/12months)

AJE #2

Internet and communication expense P4,000

Accrued expense P4,000

To record Internet and communication accrued as of December 31, 2011

AJE #3

Water and power expense P5,000

Accrued expense P5,000

To record water and power expense accrued as of the end of accounting period

AJE#4

Computer supplies expense P2,000

Unused computer supplies P2,000

To correct balance of unused computer supplies as of December 31, 2011 (P47,000 – 45,000 = P2,000)

AJE#5

Cash P50,000

Accounts receivable 60,000

Internet service income P60,000

Printing service income 50,000

To correct erroneous recording of Internet service income on account, reflecting the P60,000 that was erroneously omitted (P66,000 – 6,000 = 60,000) and to record omitted P50,000 printing service income on cash.

AJE#6

Interest expense P844

Accrued expense P844

To accrue interest expense for 19 days – Dec 12- Dec 31 [(P100,000×16%/360)x19days=P844.44]

AJE#7

Prepaid rent P15,000

Cash P15,000

To record the unexpired rental fees paid (January to March with P5,000 each month). Remember that the P5,000 rent payment for the month of December was already recorded correctly during that month.

AJE#8

Insurance expense P1,000

Prepaid insurance 11,000

Cash P 12,000

To record payment of insurance and the corresponding expense for the month of December (P12,000 x 1/12 = P1,000)

AJE#9

Taxes and licenses P5,000

Accrued expense P5,000

To accrue taxes and licenses as of December 31, 2011.

AJE#10

Income tax expense P75

Income tax payable P75

To record 2011 income tax due and payable

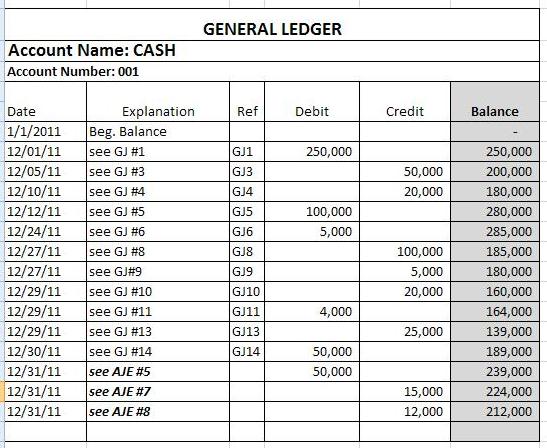

Those adjusting journal entries are recorded just like regular transactions in the journal. The entries are also posted to the ledger just like any other journal entries to update and correct the ledger account balances. Here is how the adjusting journal entries affect our cash in the general ledger:

After all the ledger balances are corrected, our trial balance should be adjusted to reflect the adjustments we have made. Our next discussion will be on how to prepare an adjusting trial balance. See you in our next post. Thank you.

Disclaimer: This article is intended for informational use only. Examples on this article are only used for illustrating and facilitating the article discussion. They don’t reflect actual scenarios or reflect actual accounting records of an actual entity or business.

Victorino Q. Abrugar is a marketing strategist and business consultant from Tacloban City, Philippines. Vic has been in the online marketing industry for more than 7 years, practicing problogging, web development, content marketing, SEO, social media marketing, and consulting.

Well simplified, got what i wanted thank you sir

Where do i find the adjusted trial balance?

Where will I base my computation of 3% percentage tax for payments with 2% creditable withholding tax? From the gross amount or from the amount after the deduction of 2%?

@Girlie Tano, computation should be based on the gross amount. The 2% CWT will serve as deduction to your income tax due as you file your income tax return.

I am having a hard time adjusting journal entries in accounting. This article definitely helped me accomplished my task. Thanks for sharing this article. This is a very helpful site to small business owner especially to newbies.