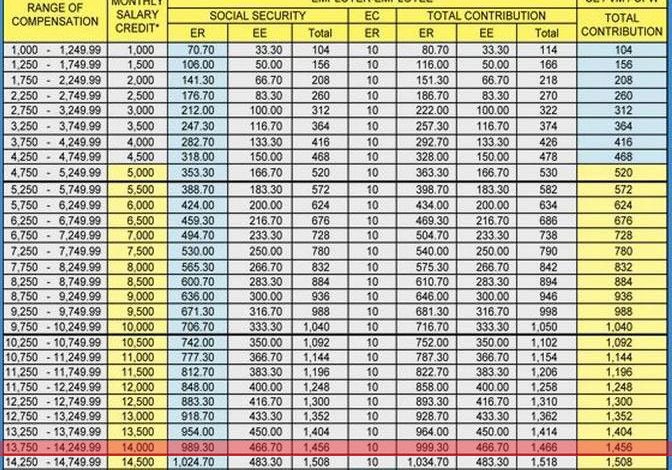

How to compute SSS contribution in the Philippines? Employers must know how much employer’s contribution (ER) they must pay to the Philippine Social Security System (SSS) for their employers. If you’re an employee, you might also ask how much employee’s contribution (EE) is … [Read more...]

Tax Guide Philippines

If you’re looking for an online tax guide in the Philippines, this blog strives to provide you that. We know that taxation is an essential part of doing business. We also understand that it may involve anyone who earns income, whether it’s from business, profession or … [Read more...]

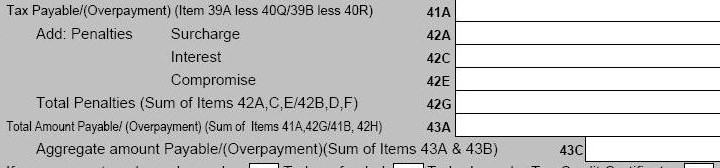

Penalties for Late Filing of Tax Returns

How to compute the penalties for late filing of income tax return in Philippines? Maybe you’re one of those taxpayers who are searching the Internet right now for any clue and answer to that question. The deadline for filing and payment of the annual income tax is April 15. But … [Read more...]

Holy Week in the Philippines: 2011 Business Ideas

Holy week, which means Hebdomas Sancta or Hebdomas Maior, "Greater Week" in Latin, is the last week of Lent and the week before Easter according to the Catholic tradition. It commemorates the last week of Jesus Christ’s life as a man on Earth, as recorded in the Canonical … [Read more...]

Income Tax Computation in the Philippines

This post is a summary of all our published articles related to income tax computation in the Philippines. The deadline for filing and paying your annual income tax return, which is on April 15, is only a few days ahead. That is why I decided to share all of our available tax … [Read more...]

How to Avoid BIR Tax Audit?

How to avoid a BIR tax audit? April 15 is fast approaching and you need to make your annual income tax complete, filed and paid before that deadline comes. But though you need to hurry to make it before the due date, it’s still better to be prudent in the preparation and … [Read more...]

- « Previous Page

- 1

- …

- 16

- 17

- 18

- 19

- 20

- …

- 23

- Next Page »