A number of new entrepreneurs find the money matters of starting their businesses among the most difficult and intimidating things they’ll need to go through. Unless it just so happens that an entrepreneur is already well-versed in tax rules and regulations, few will find the … [Read more...]

How to Fill Out BIR Form 1701A for Self-Employed and Professionals

Whether you’re a self-employed individual or a professional, it is a legal duty for every citizen in the Philippines to file an income tax return annually. This is because, according to the law, incomes, regardless of their sources, have corresponding income tax rates. … [Read more...]

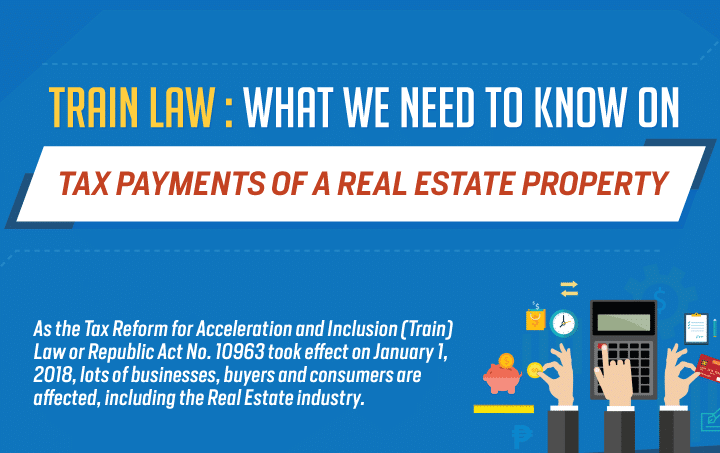

Train Law: What We Need to Know on Tax Payments of a Real Estate Property (Infographics)

Early this year, the Philippines government has enacted the Tax Reform for Acceleration and Inclusion (TRAIN) law – a reform initiative that is said to be instrumental to the poverty-reduction and economic development goals of the country. This newly-implemented law has a far and … [Read more...]

How to Deal with the Burdensome Tax Regulations in the Philippines

Tax or tax payment is a burden. Complying with several steps, processes and regulations before you can pay your taxes due is another and even a bigger burden. If you're a full-time or a pure employee, you only need to worry about the tax money which is automatically deducted in … [Read more...]

How to Reduce Your Business Income Tax by Increasing Your Generosity

So you want to pay less income tax from your business? Tax evasion is illegal, thus, I never recommend it to anyone. But tax avoidance is not. And if you will do it with good faith or with an intention to help people, tax avoidance can be a great way to minimize your business' … [Read more...]

Tax Blog in the Philippines

Majority of our visitors and readers come to our blog in search for tax articles like income tax computation, filing of ITR, getting TIN, business registration with the BIR, and other tax tips for businesses in the Philippines. No wonder many of my close friends are telling me … [Read more...]